Drone Insurance – What It is & Why You Need It.

For many who fell in love with drones after their first flight, they never thought that they may go into business using them.

After realizing they were great at handling the controls, navigating the skies, and preventing crash landing, many entrepreneurs out there realized that they could capitalize quite well by honing their skills a bit more, placing some online ads, and reaping high-paying clients.

Just like any business, there are many things that can go wrong, and when you add to the formula the fact that you are hurtling through airspace trying to get great footage may pose the occasional random threat or two.

Just as any contractor would, describing how you have insurance can help greatly when you are trying to land clients: many of them may expect you to be fully covered in this area, to increase your standard of safety.

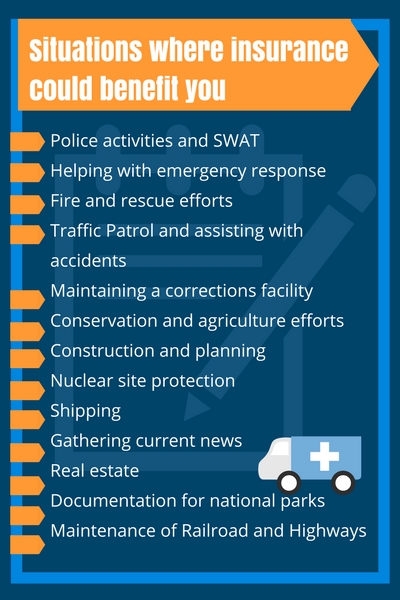

It may be within the realm of real estate photography, surveying, or getting footage for a sporting event: there are many different uses of drones that can ultimately generate the owner revenue.

Even though delivery services are not quite the norm yet, after some legal issues are worked out over the following year, they may become common, and many different types of coverage will pop up undoubtedly for these ventures.

If I am in business, is insurance absolutely essential?

Photo Flickr by Tobi Gaulke

The first question that many new drone operators ask is regarding homeowner’s insurance. Even if you are just setting off to the skies in your backyard, these type of policies usually do not cover anything related to your use.

Many of the types of insurance available currently will only insure you if you are a commercial pilot: recreational use will have more bearing in the years to come.

Right now in the United States, it is not mandatory for those running businesses OR recreational pilots to have insurance, but in Canada, one who is running a business needs to be covered under a liability policy for at least $100,000.

In some instances, a specific project you take on may require a minimum level of coverage. As in most contract ventures such as roofing and electrical work, insurance is one way to show that you are reliable, trustworthy, and that you understand the ropes and workings of the modern world.

Drone Insurance Defined

When you take out an insurance policy regarding your drone, it acts like most any other policy would. The main reasons why people want to take out policies are if a drone becomes lost, or if you get into a sizable accident while on the job.

Sometimes they will require proof of extensive training, and definitely want pilots to have very detailed manuals and logs about what they have been doing.

Also, having very up-to-date records and maintenance logs is heavily appreciated by insurance companies.

The more time you have spent preparing yourself, the higher the chance of you scoring great coverage, and being able to get a rate that won’t break your monthly budget. Here are some different types of things that you could be insured for in the drone realm, and situations where insurance could benefit you greatly.

What types of cost can you expect to pay for drone insurance?

When your business is all set up and you have figured out how you are going to use drones to your advantage, you will be ready to assess just how to handle the insurance issue. For a drone such as the Dji Phantom 4, you can currently acquire a liability only police that will insure the pilot for around one million dollars for around $700 a year.

The factors that are looked at when issuing these policies are volume of business, experience, and piloting background.

There are some very good companies out there such as Verifly that provide their services on demand; and this can be a great solution for someone still working a full-time career that is beginning a drones business.

If your week is taken up working an office job, but you are beginning to branch out and capture drone footage on the weekends, companies like this off coverage by the hour, a true perk in today’s fast-paced world.

Here are some questions the insurance agent may ask when creating the application that will eventually give you coverage for your flights:

1. How many hours of official flight time have you logged as a pilot?

2. Do you have possession of a maintenance log?

3. Due to recent changes in law, are you an FAA-licensed pilot?

4. Is the equipment you use yours, or are you leasing it?

5. What quality is your marketing material?

6. Do you predominantly operate indoors, or outdoors over water?

7. Is there any record of accidents on your behalf during the past?

What is usually covered under a policy is the drone itself: the most important part of your investment that you don’t want to go up in smoke. Just like many other forms of insurance, the average deductible is around $500.

Coverage always depends on the circumstances that surround the accident, and investigators take a close look to see whether or not negligence was a factor during any accidents.

What many insurance agents and those who are front and center in the drone community agree on is that there is a high amount of negativity when it comes to drones, because so many things about them seem foreign and new to the general population.

Things you’ll need to get started

Just as if you were looking for auto insurance or any other entity of coverage, you need to check out multiple companies to see which one will ultimately fit your needs the best. Keep these categories of info handy, as they will help you apply for and find the right commercial drone operator’s coverage for you.

• Personal info that includes your address and ways to contact you

• The type of coverage that you need for your drone

• Specific breakdowns of how much each part of your rig costs

• Information about the areas you are planning to operate

• The number of flying hours you have under your belt

• Various types of training you have received

• Information regarding any past loss of property or accidents

• Grant-related info regarding 333 exemption and other paperwork documenting any financial backing your entity or LLC may possess

What happens when you need to file a claim?

If something happens to you while you are going about your daily business, you’re going to want to know how to file a claim. Stay calm, and realize that you have done the right thing by preparing with a proper insurance policy, and follow these general guidelines:

1. Go over the insurance policy in detail, and check out which specific duties you need to get done. Understanding fully what the insurance provider does and does not want you to do is quintessential during the time that a claim has to be made.

2. Tell the insurance company what happened as soon as humanly possible. Take very specific note of the time, place, description of what happened, names of those involved, and contact information for any witnesses or those who were hurt on accident.

3. Notify the police: If the issue is theft, vandalism, or an accident that could result in harm, make sure you call them for security and documentation immediately.

4. Be careful about making any statements about the event without getting the permission of the insurance company first. This could make matters in the public eye and with anyone you are doing business with temporarily even worse.

5. Do not abandon the site where the drone is; as soon as an accident takes place, make sure you are taking any precautions needed to protect the property right after the accident happens. If a police report is eventually filed, this will just add to suspicions.

6. Cooperate well with the insurance company’s representative, and fully realize that this is your ticket to having a smooth claim. Don’t get moody, brash, or too dominating in your conversations with them, and realize that they are there to help.

7. Within a reasonable amount of time, remember to file proof of loss with the insurance Co.

Is it possible to have your insurance canceled?

When you are driving and have an accident, (or more than one), there are sometimes great repercussions, and the same can hold weight within the drone realm.

The last thing you want to start your day with as a business owner is a cancellation notice, and so here are some of the reasons why your provider may choose to end your relationship.

• Not having proper flight logging, and lacking proof of what happened during a major accident.

• Failing to register a serial number and putting your personal ID number on your drone

• Failing to log cycles of battery use and charging, as well as when you change propellers.

• Participating in flight that pushes ethical limits, and not being cautious with video uploads that contain the evidence.

• Actively destructing property or bumping into objects aggressively

What are some companies that provide drone insurance?

Before we provide you a list of some companies that provide drone insurance, we just wanted to make one thing clear: many that ask if they are covered for commercial ventures in the drone world wonder if their AMA membership provides them a form of drone insurance.

In an official summary of insurance provided last year, it is clearly stated that the $2.5 million liability policy under the guise of the AMA does not cover business pursuits, and so if you are planning on expanding a drone business, the AMA insurance is not sufficient. Here are some drone insurance brokers that can quickly come to your rescue:

• Aerial Pak

• Avalon Risk Management

• Aviation Insurance Resources

• AVION Insurance

• Harpenau Insurance Agency

• Houston Casualty

• MeadowBrook

• Sutton James Incorporated

• Swiss RE

• UAV Project

• Verifly

• XL Catlin

When you are dealing with flying drones for a living, the last thing you want is to accidentally run into a building or other structure, let alone another person while doing your job. If this ever does happen, the peace of mind you’ll get from having a policy that protects you will be invaluable, and you will be cruising your drone through the skies with ease and comfort.